All Categories

Featured

Table of Contents

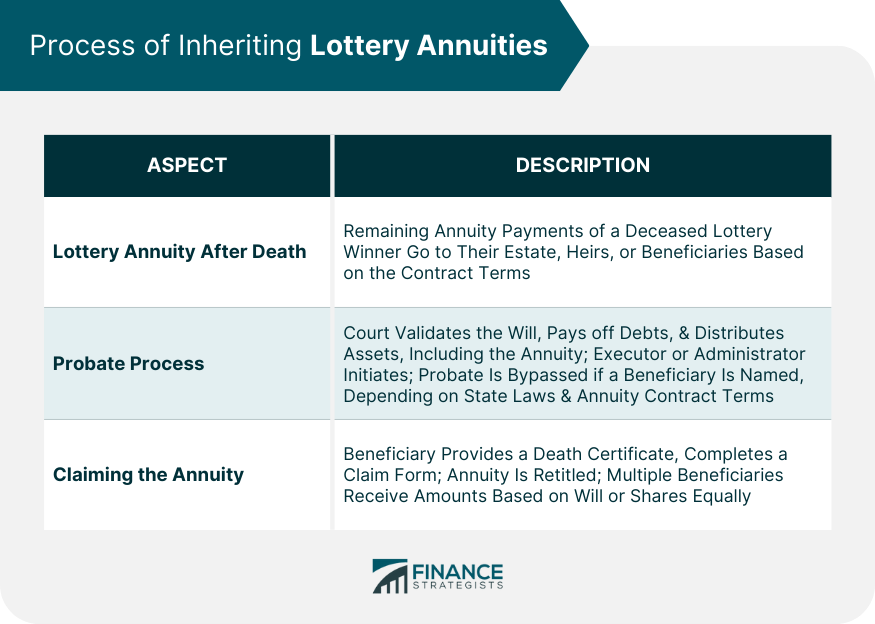

Maintaining your classifications up to day can make sure that your annuity will be handled according to your dreams need to you pass away suddenly. A yearly review, major life occasions can prompt annuity owners to take one more look at their recipient options. "Someone might want to update the recipient classification on their annuity if their life situations change, such as marrying or divorced, having kids, or experiencing a fatality in the family," Mark Stewart, CPA at Action By Step Business, told To transform your recipient designation, you need to reach out to the broker or representative that manages your contract or the annuity service provider itself.

Just like any type of financial product, looking for the assistance of an economic advisor can be valuable. A financial coordinator can guide you with annuity management processes, including the methods for updating your agreement's recipient. If no recipient is named, the payout of an annuity's death advantage goes to the estate of the annuity owner.

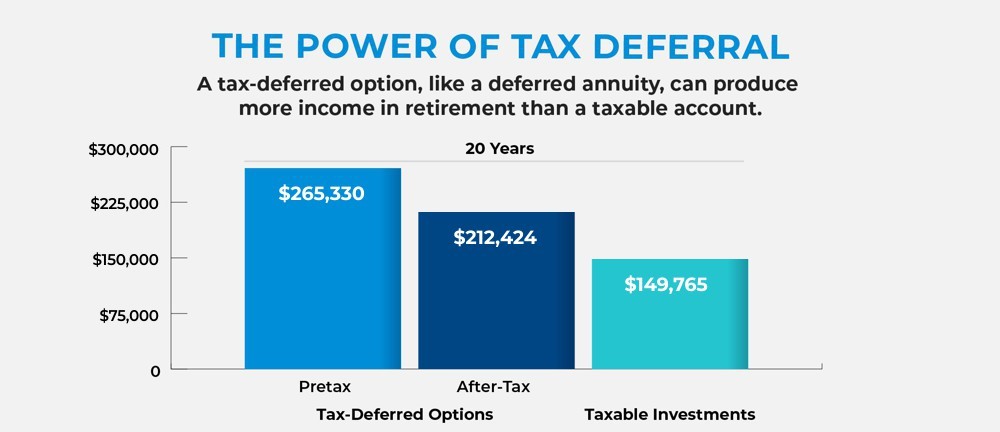

Acquiring an annuity can be an excellent windfall, however can additionally elevate unexpected tax obligation obligations and management burdens to take care of. In this message we cover a couple of basics to be familiar with when you acquire an annuity. First, recognize that there are 2 kinds on annuities from a tax point of view: Certified, or non-qualified.

When you take cash out of an acquired certified annuity, the full quantity taken out will certainly be counted as gross income and exhausted at your common income tax obligation price, which can be fairly high relying on your financial circumstance. Non-qualified annuities were funded with cost savings that already had actually taxes paid. You will not owe tax obligations on the initial price basis (the total payments made originally right into the annuity), but you will certainly still owe taxes on the growth of the financial investments nonetheless and that will certainly still be exhausted as revenue to you.

Particularly if the original annuity proprietor had actually been obtaining settlements from the insurance coverage business. Annuities are typically designed to provide income for the initial annuity owner, and after that cease repayments when the original owner, and probably their partner, have actually passed. Nonetheless, there are a few scenarios where an annuity might leave an advantage for the beneficiary inheriting the annuity: This suggests that the initial owner of the annuity was not obtaining routine payments from the annuity yet.

The recipients will have a number of options for exactly how to get their payment: They might maintain the cash in the annuity, and have the possessions transferred to an acquired annuity account (Annuity payouts). In this case the possessions might still continue to be invested and proceed to grow, nevertheless there will be required withdrawal rules to be familiar with

Tax rules for inherited Annuity Death Benefits

You may additionally be able to pay out and get a round figure repayment from the inherited annuity. However, be certain you comprehend the tax obligation influences of this choice, or talk with a financial advisor, since you may undergo substantial earnings tax obligation by making this political election. If you elect a lump-sum payout choice on a qualified annuity, you will subject to income taxes on the whole value of the annuity.

Another attribute that might exist for annuities is a guaranteed survivor benefit (Annuity income riders). If the initial owner of the annuity elected this function, the recipient will be eligible for an one time round figure benefit. Exactly how this is strained will depend upon the type of annuity and the value of the death advantage

The certain regulations you need to follow depend upon your relationship to the individual that passed away, the sort of annuity, and the wording in the annuity contract at time of purchase. You will have a collection amount of time that you should withdrawal the properties from the annuity after the initial proprietors death.

Due to the tax obligation repercussions of withdrawals from annuities, this implies you require to carefully plan on the most effective way to take out from the account with the most affordable quantity in tax obligations paid. Taking a large round figure may push you right into really high tax braces and cause a bigger portion of your inheritance going to pay the tax obligation bill.

It is additionally crucial to understand that annuities can be traded. This is referred to as a 1035 exchange and allows you to move the cash from a certified or non-qualified annuity right into a various annuity with one more insurer. This can be a great option if the annuity contract you acquired has high costs, or is just not appropriate for you.

Handling and spending an inheritance is incredibly vital duty that you will certainly be required into at the time of inheritance. That can leave you with a great deal of inquiries, and a whole lot of potential to make pricey mistakes. We are here to assist. Arnold and Mote Wealth Administration is a fiduciary, fee-only economic organizer.

Is there tax on inherited Retirement Annuities

Annuities are among the several devices financiers have for developing riches and securing their financial well-being. An acquired annuity can do the exact same for you as a beneficiary. are agreements between the insurance policy companies that issue them and the individuals who buy them. There are different kinds of annuities, each with its very own benefits and attributes, the key facet of an annuity is that it pays either a series of payments or a swelling amount according to the contract terms.

If you just recently acquired an annuity, you may not know where to start. Annuity owner: The individual who gets in right into and pays for the annuity agreement is the proprietor.

An annuity might have co-owners, which is commonly the situation with spouses. The owner and annuitant may be the exact same person, such as when somebody purchases an annuity (as the owner) to supply them with a repayment stream for their (the annuitant's) life.

Annuities with numerous annuitants are called joint-life annuities. Just like several owners, joint-life annuities are an usual framework with couples since the annuity continues to pay the making it through partner after the initial partner passes. This can give earnings safety and security in retired life. Recipients: Annuity recipients are the parties to obtain any applicable survivor benefit.

It's feasible you may get a fatality benefit as a recipient. Nonetheless, that's not constantly the situation. When a survivor benefit is caused, repayments may depend partly on whether the proprietor had actually already begun to obtain annuity settlements. An inherited annuity survivor benefit works in different ways if the annuitant wasn't currently getting annuity settlements at the time of their passing away.

When the benefit is paid out to you as a swelling amount, you get the whole amount in a solitary payment. If you elect to obtain a settlement stream, you will certainly have a number of choices readily available, depending upon the agreement. If the proprietor was already receiving annuity repayments at the time of death, then the annuity agreement may just terminate.

Table of Contents

Latest Posts

Understanding Financial Strategies Key Insights on Your Financial Future What Is Tax Benefits Of Fixed Vs Variable Annuities? Features of Smart Investment Choices Why Choosing the Right Financial Stra

Exploring Fixed Indexed Annuity Vs Market-variable Annuity Everything You Need to Know About Variable Vs Fixed Annuities What Is Tax Benefits Of Fixed Vs Variable Annuities? Features of What Is A Vari

Understanding Fixed Income Annuity Vs Variable Growth Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Pros and Cons of Vari

More

Latest Posts